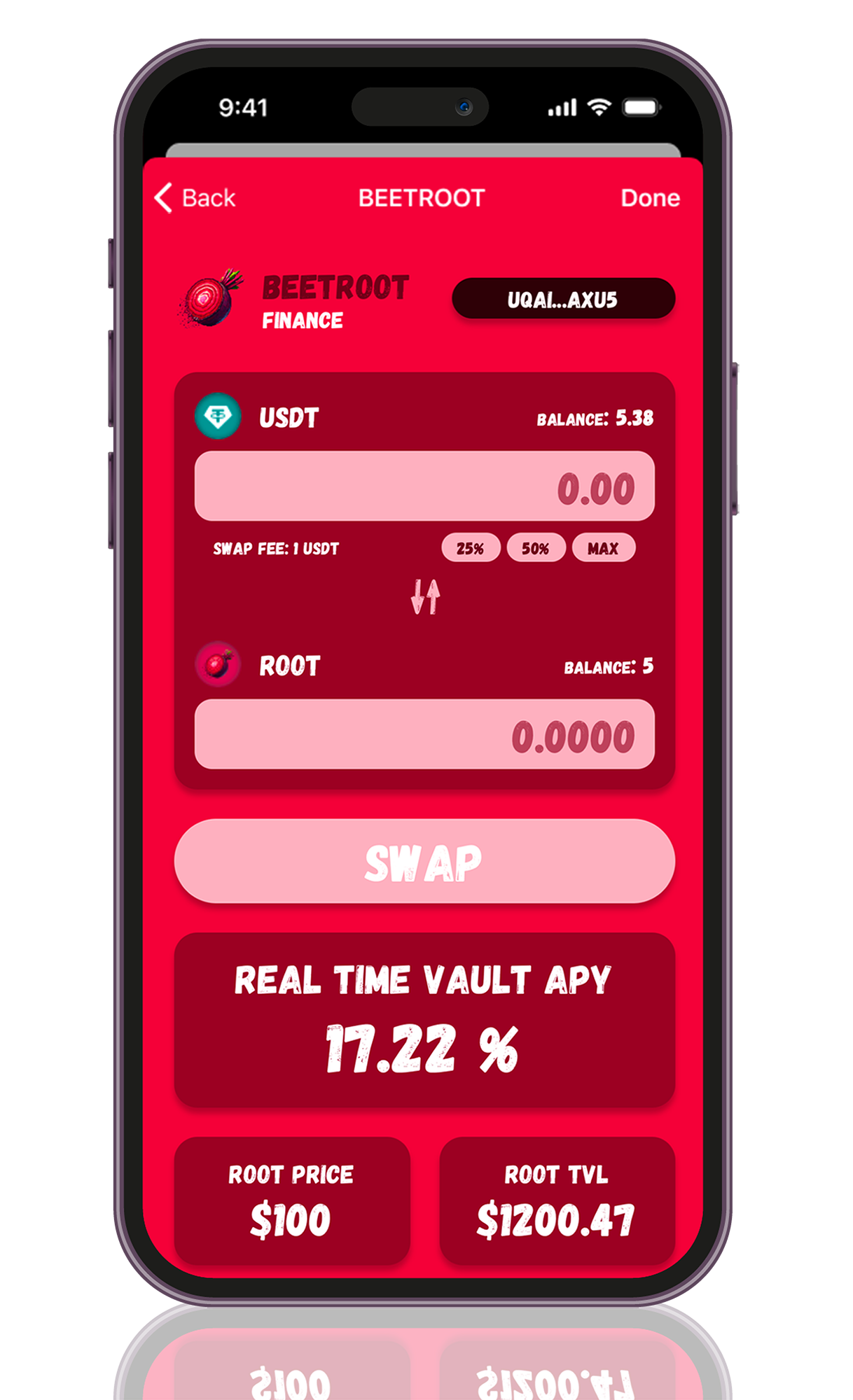

As a core component of the TON ecosystem, Beetroot Finance empowers users to optimize their returns by engaging in yield farming across various DeFi protocols.

What sets yield farming with Beetroot is its seamless integration with user-friendly dApps and advanced smart contract technology. We utilize automated algorithms to rebalance funds and ensure competitive returns.

Moreover, TON's low transaction costs and fast processing times make us an ideal platform for yield farming, allowing for frequent interactions with liquidity pools without incurring significant fees.

Whether you are a seasoned DeFi user or a newcomer, Beetroot Finance provides a reliable and scalable environment to explore yield farming opportunities on TON blockchain, contributing to the growth and adoption of decentralized finance.